Literature review of a seminal paper by George Akerlof and Rachel Kranton.

Inculcating in employees a sense of identity and attachment to the organization may do good to the well-functioning of the whole group. \

Monetary incentives remain a blunt instrument.

(1) Compensation schemes are based on observable variables. But these variables are at best a proxy of effort and ability of the employees. Information asymmetry still exists, incurring moral hazard and adverse selection.

(2) Monetary compensation may have negative effects. For example, employees may overperform on well rewarded tasks and underperform on poorly rewarded tasks. Workers may also backstab one another to be the best relative performer.

Vilfredo Pareto noticed that much of the utility depends not only on what economists usually think of as tastes, but also on norms as to how people think that they and others should behave. Another observation is how people should behave depends upon the particular situation.

The term identity is used to describe a person's social category---gender, race, group affiliation...It is also used to describe a person's self-image. IN a model of utility, a person's identity describes gains and losses in utility from behavior that conforms or departs from the norms for particular social categories in particular situations. In this model, individuals' utility function can change because people internalize norms at different time periods, triggered by different actions.

We add a new variable, identity to basic principal-agent model.

In this new model, the worker's utility varies with his category as either an insider or an outsider, and his utility depends on his effort from the ideal for his respective social category, depending on his identity and situation.

Effect of adding this new variable:

When the agent sees himself as an insider, he max his identity utility by exerting the high effort, and thus he doesn't need a large difference in monetary rewards to induce him to work hard. If the agent sees himself as an outsider, then he requires a higher wage differential to compensate him for the utility he loses when he works in the interests of the firm.

The firm may have incentive to change the agent from an outsider to an insider.

What restricts the individual's freedom is not other people's violence or threat of violence, but the physiological structure of his body and the inescapable nature-given scarcity of the factors of production.--------Ludwig Von Mises

11/30/2013

11/27/2013

perfect rationality....wait are you kidding me?

In game theory, a fundamental assumption is that people are rational in making decision each time they are called upon to move. Sometimes counter-intuitive equilibria occur in stylized game theory models and it makes people wonder: are people really that rational in making every decision in their daily life? One thing I feel certain about is that I'm not...

For decades a new sub-field of economics, behavioral economics, has been challenging the orthodox assumptions of neo-classical econ that people are predictably rational. Behavioralists have a point right: people can't be as rational as economists assumed in their models. Our brains are not powerful enough to make choices with no consideration of emotion, and most people won't make consistent strategies in subject to Bayes' rule of probability.

Behavioralists come up with a definition, bounded rationality, to state that people's rationality of decision making is impaired by mental constraints on information processing and probability calculation.

Yes I admit that people are not rational all the time, but the market still doesn't fail because it induces participants to be more rational than they otherwise would be in an environment with no price. Trials and errors entail progress and as participants get more experienced, they would know the tacit rules and have better outcomes. In game theory terminology, this is called the refined equilibrium. Mathematically most games have an odd number Nash Equilibira and some equilibria don't make much economic sense. I call them "irrationally rational equilibrium". To winnow out the bad equilibrium, game theorists come up with some refinement strategies like trembling hand equilibrium, consistent belief and reasonable beliefs. One thing surprising is that...after all these delicate and smart manipulations, the final results of games are often what we see in daily life! That is, perfect rationality can mimic the outcome of seemingly irrational behavior in market context.

One drawback of behavioral econ experiments is that they are mostly done in labs, which is a different environment from market, and thus the result may not be compatible with what people really would choose given that they are in a more dynamic and chaotic atmosphere.

For decades a new sub-field of economics, behavioral economics, has been challenging the orthodox assumptions of neo-classical econ that people are predictably rational. Behavioralists have a point right: people can't be as rational as economists assumed in their models. Our brains are not powerful enough to make choices with no consideration of emotion, and most people won't make consistent strategies in subject to Bayes' rule of probability.

Behavioralists come up with a definition, bounded rationality, to state that people's rationality of decision making is impaired by mental constraints on information processing and probability calculation.

Yes I admit that people are not rational all the time, but the market still doesn't fail because it induces participants to be more rational than they otherwise would be in an environment with no price. Trials and errors entail progress and as participants get more experienced, they would know the tacit rules and have better outcomes. In game theory terminology, this is called the refined equilibrium. Mathematically most games have an odd number Nash Equilibira and some equilibria don't make much economic sense. I call them "irrationally rational equilibrium". To winnow out the bad equilibrium, game theorists come up with some refinement strategies like trembling hand equilibrium, consistent belief and reasonable beliefs. One thing surprising is that...after all these delicate and smart manipulations, the final results of games are often what we see in daily life! That is, perfect rationality can mimic the outcome of seemingly irrational behavior in market context.

One drawback of behavioral econ experiments is that they are mostly done in labs, which is a different environment from market, and thus the result may not be compatible with what people really would choose given that they are in a more dynamic and chaotic atmosphere.

11/03/2013

Unemployment insurance

The US unemployment insurance includes 53 separate jurisdictions, each with unique laws and operating procedures. The system is financed through a federal tax on payrolls, and the majority of the benefits paid by the system are collected by state-level taxes. During recessions, additional federal involvement kicks in.

Many unemployed workers are not covered either because they are recent entrants to the labor market or they quit jobs voluntarily. Some unemployed are not eligible for the insurance because they have not earned enough in their previous recent jobs or they have exhausted the insurance. Some unemployed don't get covered because they didn't file for the insurance in the first place.

Programs in different states vary due to difference in four general areas: rules of eligibility, what jobs are covered, variation in weekly benefit amounts, and variation in weeks for exhaustion.

Eligibility:

To be eligible, three conditions must be met:

(1) whether a worker has sufficient employment during some defined base period

(2) whether a worker has an acceptable reason for the job separation

(3) whether a worker continues to be unemployed, (in other words, determine if he actively searches new job while collecting the insurance)

The problem of condition (1): it may exclude low-wage, temporary workers and those who have a short labor history.

Condition(2): may be hard to differentiate voluntary quitting

Condition(3): information problem (Hayek's critique I guess...)

Unemployment insurance to some extent prevent major declines in consumption spending in response to layoffs, but we have to consider that variation across workers and those who don't collect insurance.

Design of unemployment insurance:

1) most models find that optimal replacement ratios are less than 1 when unemployment benefits pose significant disincentive to find work

2) models that allow for realistic levels of personal borrowing and saving lead to lower optimal replacement ratios than those that do not.

3) replacement rates that decline over the duration of the unemployment spell may be perferable to constant wage replacement rates

4) consider moral hazard when deciding the duration of insurance coverage.

Many unemployed workers are not covered either because they are recent entrants to the labor market or they quit jobs voluntarily. Some unemployed are not eligible for the insurance because they have not earned enough in their previous recent jobs or they have exhausted the insurance. Some unemployed don't get covered because they didn't file for the insurance in the first place.

Programs in different states vary due to difference in four general areas: rules of eligibility, what jobs are covered, variation in weekly benefit amounts, and variation in weeks for exhaustion.

Eligibility:

To be eligible, three conditions must be met:

(1) whether a worker has sufficient employment during some defined base period

(2) whether a worker has an acceptable reason for the job separation

(3) whether a worker continues to be unemployed, (in other words, determine if he actively searches new job while collecting the insurance)

The problem of condition (1): it may exclude low-wage, temporary workers and those who have a short labor history.

Condition(2): may be hard to differentiate voluntary quitting

Condition(3): information problem (Hayek's critique I guess...)

Unemployment insurance to some extent prevent major declines in consumption spending in response to layoffs, but we have to consider that variation across workers and those who don't collect insurance.

Design of unemployment insurance:

1) most models find that optimal replacement ratios are less than 1 when unemployment benefits pose significant disincentive to find work

2) models that allow for realistic levels of personal borrowing and saving lead to lower optimal replacement ratios than those that do not.

3) replacement rates that decline over the duration of the unemployment spell may be perferable to constant wage replacement rates

4) consider moral hazard when deciding the duration of insurance coverage.

10/19/2013

Summary of Home ownership, job duration, and wages

In this paper, the

authors first hypothesized that employed home owners, compared to renters, are

less likely to be unemployed, have longer employment spell lengths, and earn

higher wages. Then the authors tested the hypotheses empirically based on a

rich Danish micro data set. The data set they used covered one percent of the

Danish population from years 1993 to 2001 and contained detailed information of

housing, labor market experiences and demographic characteristics. The pattern of the data showed that on

average homeowners have more favorable labor market outcomes than renters.

To investigate the

impact of home ownership on job duration and wages, the authors specified a

competing risks duration model for job spells, used a mixed proportional hazard

model for the labor market transitions to capture unobservable work characteristics,

and estimated a standard human capital wage equation.

To identify the causal

linkage between homeownership and hypothesis, the authors modelled the

selection process into homeownership and used two different identification

strategies to check the robustness of their results. The first identification

related to the fact that some people change their home ownership status during

job spells. This identification required authors to observe job spells both

when the individual is a home owner and when he is a renter. Conditional on

heterogeneity, it helped authors to see the relation between employment

outcomes and home ownership status. The second identification was about

exclusion restrictions, which helped tease out variables that affect home

ownership decision but have no direct impact on labor market outcomes. The

authors considered regional home ownership rate, home owner status of the

parents, and home ownership rate in the region of birth as variables that only

affected home ownership status. The whole model endogenized home ownership

status.

The results of the

paper were conform to the hypotheses. Home owners are less likely to transit into

new jobs, and they earn higher wages. The paper suggests that there are labor

market gains for homeownership. The problem of the model is that to make it

more tractable, the authors restricted the correlation structure.

Summary of Tenure Choice and Labor Market Outcomes

This paper tested at the individual level the argument

that regional homeownership rates are positively correlated with regional

unemployment rates.

The null hypotheses were based on search theory which

argued that renters have a higher matching rates to firms while home owners, due

to fixed cost in property acquisition and immobility, suffer more from regional

demand shocks. Specifically, the hypotheses contends that renters, compared to

homeowners, have lower unemployment probabilities, shorter duration of unemployment

and higher wages.

Some previous research papers

showed that at aggregate level house ownership has a negative impact on labor

market outcomes. However, these papers failed to present evidence at individual

level. Besides, much of the current evidence is bivariate, which means there

may be omitted variables involved. To test hypotheses at individual level,

Coulson and Fisher used two data sets, namely the March 2000 wave of Current

Population Survey (CPS) and 1993 wave of the Panel Survey of Income Dynamics

(PSID), with a multivariate model.

The CPS data included information

on 29753 individuals’ housing, labor market experiences and demographic

characteristics. The sample reflected the relatively wealthier portion of the

country. Coulson and Fisher first used probit model, in which the dependent

variable is a dummy variable, to test the hypothesis that homeowners are more

likely to be unemployed. The univariate test turned out to reject the

hypothesis. To tease out the impact of omitted variables, Coulson and Fisher

then added some other significant variables such as age, races, education

levels, marital status, and locations, but refined regression still rejected

the hypothesis.

Coulson and Fisher then used CPS

data and OLS method to test the hypothesis that renters have more wages. Both

the unconditional and conditional tests showed that home owners have more wages

than renters, which rejected the hypothesis.

Having rejected the first and

third hypothesis using CPS data, Coulson and Fisher used PSID to test the three

hypotheses, particularly the second that renters have shorter duration of

unemployment. Compared to CPS, which only included a simple cross-section, PSID

had longitudinal data, which could be better used to test spell length of the

sample. The sample consisted of 5125 individuals, which had on average lower

incomes, lower education levels and younger ages compared to those in the CPS

data. The univariate and multivariate regression tests both showed that home

ownership is a significant negative indicator for unemployment and home owners

earn more than renters. Assuming that the length of spells satisfies Weibull

distribution, Coulson and Fisher ran the regression and found that home

ownership exerts a negative influence on the length of the unemployment. The

second hypothesis was rejected.

Coulson and Fisher rejected the

null hypotheses that homeowners have lower unemployment probabilities, longer

unemployment spells and lower wages than renters. The possible reasons why the

hypotheses didn’t hold may be that mobility of renters tend to equalize

unemployment rates across areas regardless of the homeowners’ behavior, or firms

don’t observe status of homeownership and tend to pool renters and owners into

a single labor market.

However, this paper was

criticized by Munch, Rosholm, and Svarer. They pointed out that Coulson and

Fisher didn’t address the potential endogeneity of the home owner variable,

which made it unclear if the positive labor market outcomes for home owners are

causal or spurious.

9/29/2013

The economics of the tenure system

The degree of job security for tenured faculty is higher relative to other kinds of jobs, but whether it is excessive is a different question.

The tenure system provides higher job security than a for-profit company would, but the monetary compensation is lower.

The correct view of the tenure contract is that universities get high-priced talent at a low monetary cost; they pay instead by providing job security.

While tenure provides job security, it doesn't guarantees a lifetime increase in salaries.

The disincentive of tenure system:

Untenured faculty view tenure as a incentive to work hard, but the desire to earn tenure also makes them cautious during the pre-tenured years. Many of them fear that unconventional teaching would impair their chance to get the tenure and thus they conform to conventional teaching and research topics that would pay off in a shorter time period. But when they take such mainstream teaching styles and research methods, the cost of innovative research and teaching at post-tenure career would be huge because they have locked in and failed to adopt more daring ways.

The tenure system provides higher job security than a for-profit company would, but the monetary compensation is lower.

The correct view of the tenure contract is that universities get high-priced talent at a low monetary cost; they pay instead by providing job security.

While tenure provides job security, it doesn't guarantees a lifetime increase in salaries.

The disincentive of tenure system:

Untenured faculty view tenure as a incentive to work hard, but the desire to earn tenure also makes them cautious during the pre-tenured years. Many of them fear that unconventional teaching would impair their chance to get the tenure and thus they conform to conventional teaching and research topics that would pay off in a shorter time period. But when they take such mainstream teaching styles and research methods, the cost of innovative research and teaching at post-tenure career would be huge because they have locked in and failed to adopt more daring ways.

9/16/2013

Dining and Housing

Student dining and housing are enterprise units in some schools, which means that they are expected to fully cover their operating and capital costs and receive no subsidies from the general operating budget of the university. But their operation still have impact on the rest of the university.

Higher dining rates increase the total costs of attending the university. It is the total cost of attending the school, not its tuition and fees, that influences accepted students' decisions to attend the school. It is also the total costs that determine the financial aid that is provided for students. Increased financial aid costs or reduced tuition revenues both mean that less money will be available to spend on the academic functions to the universities.

Higher dining rates increase the total costs of attending the university. It is the total cost of attending the school, not its tuition and fees, that influences accepted students' decisions to attend the school. It is also the total costs that determine the financial aid that is provided for students. Increased financial aid costs or reduced tuition revenues both mean that less money will be available to spend on the academic functions to the universities.

Intercollegiate athletics and gender equity

Even if the athletics department loses money on its operation, the claim is made that these sports are investments that generate considerable funding in the form of alumni contributions to the university as a whole.

A number of academic studies confirm that football bowl game appearances and basketball appearances in the NCAA men's basketball tournament have a positive effect both on the contributions that universities receive from alumni and on the quality of their entering students.

Intercollegiate athletics is more a participation activity than a spectator activity for students at Ivy League universities.

Public universities have long used success on the athletic field as a way of generating alumni and political support for their institution. To compete on the playing field with the public institutions in their conferences, Stanford, Duke, and Northwestern have all adopted the conference policy of awarding athletic scholarships.

Gender-equity efforts will have real financial cost if a university isn't able to bring itself to deeply cut male athletic programs. Sometimes gender-equity requirements add to the cost of existing women's sports.

A number of academic studies confirm that football bowl game appearances and basketball appearances in the NCAA men's basketball tournament have a positive effect both on the contributions that universities receive from alumni and on the quality of their entering students.

Intercollegiate athletics is more a participation activity than a spectator activity for students at Ivy League universities.

Public universities have long used success on the athletic field as a way of generating alumni and political support for their institution. To compete on the playing field with the public institutions in their conferences, Stanford, Duke, and Northwestern have all adopted the conference policy of awarding athletic scholarships.

Gender-equity efforts will have real financial cost if a university isn't able to bring itself to deeply cut male athletic programs. Sometimes gender-equity requirements add to the cost of existing women's sports.

9/15/2013

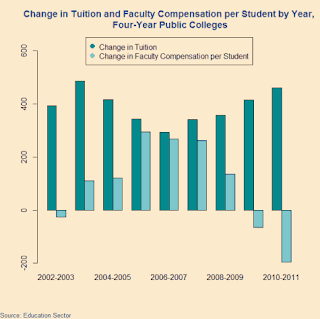

State higher education cuts

Every state but Vermont is required by its constitution to balance its budget every year. In recessions when tax revenues fall and social welfare expenditure like Medicaid and TANF increases, either tax should be increased or some other public expenditure has too be cut.

But this can only explains the case of community colleges.

Baumol disease problem in higher education. It doesn't fully explain why college tuition is rising so much.

Now that there are many more PhDs, especially in the humanities, than tenure-track spots for them, the salaries of instructors are actually falling as universities turn to adjuncts. That directly contradicts the Baumol explanation.

Robert Martin at Centre College did a research showing that between 1987 and 2008, full professor salaries increased by an average of 0.9 percent a year, and assistant professor salaries by a measly 0.7 percent a year. But support staff salaries grew at more than double that rate. If the core act of teaching is driving costs higher, that just shouldn't be happening.

A more plausible theory might be Bowen theory: universities will spend all the money they can possibly raise. If they raise more than they need for educational objectives, they will spend it on non-educational uses like climbing walls and nicer buildings.

Revenue theory of cost:

"

But this can only explains the case of community colleges.

Baumol disease problem in higher education. It doesn't fully explain why college tuition is rising so much.

Now that there are many more PhDs, especially in the humanities, than tenure-track spots for them, the salaries of instructors are actually falling as universities turn to adjuncts. That directly contradicts the Baumol explanation.

Robert Martin at Centre College did a research showing that between 1987 and 2008, full professor salaries increased by an average of 0.9 percent a year, and assistant professor salaries by a measly 0.7 percent a year. But support staff salaries grew at more than double that rate. If the core act of teaching is driving costs higher, that just shouldn't be happening.

A more plausible theory might be Bowen theory: universities will spend all the money they can possibly raise. If they raise more than they need for educational objectives, they will spend it on non-educational uses like climbing walls and nicer buildings.

Revenue theory of cost:

"

1. "The dominant goals of institutions are educational excellence, prestige, and influence."

2. "There is virtually no limit to the amount of money an institution could spend for seemingly fruitful educational ends."

3. "Each institution raises all the money it can."

4. "Each institution spends all it raises."

5. "The cumulative effect of the preceding four laws is toward ever increasing expenditure."

For details, read the paper by Ronald Martin and R. Carter Hill.

Three reasons tuition is rising

Research universities are spending too much. Even the record-high tuition cannot make up the volume of spending.

For many public universities, they rise tuition to shift cost because their support from state and local government has been shrinking. Community colleges have to keep cutting spending despite rise of tuition.

For non-research schools like liberal and arts colleges, their spending is increasing, yet their tuition is increasing more because they have to compensate for decline of donation and make up the new spending.

Source: Washington Post

For many public universities, they rise tuition to shift cost because their support from state and local government has been shrinking. Community colleges have to keep cutting spending despite rise of tuition.

For non-research schools like liberal and arts colleges, their spending is increasing, yet their tuition is increasing more because they have to compensate for decline of donation and make up the new spending.

Source: Washington Post

5/02/2013

Last banking class notes

Interstate banks provide convenience to customers. Lower cost due to economies of scales. More competition in banking sectors.

Drawbacks of branching of banks:

(1) we see a draining of deposit funds from local communities to other parts of the country.

(2) Banks become much larger and resemble "too big to fail".

Regulation in financial sectors may be the clearest test of how regulation works in a market. In other words, if regulation works anywhere, it must be the case that it works best in terms of financial market. Reason: Compared to other sectors, transparency in financial market is higher. Banks report vast quantities of data to regulators, and it is very easy for regulators to check those numbers.

Why is financial regulation doomed to fail?

(1) Ordinary people don't care about risks in their banks---- most people cite location as the most important reason for choosing a bank.

(2) Standardization: getting a mortgage or a loan is the same process no matter the banks are. Different banks evaluate them in the same way, following the guide lines of the Fed. The influence of the Fed goes beyond banks' balance sheets because banks follow the guidelines of the Fed.

(3) Less competition--regulation puts barrier in the way of starting a new bank.

(4) Less choice--can't share its own currency. (But most banks still provide checking account, which is private money, consisting a large chunk of the whole money supply in the economy.)

The creation of derivatives doesn't eliminate the risks. What we should care about is to when risks will explode and harm other people. It's not possible to prevent crisis from happening.

The point of regulation is to protect the sanctity of the payment system.

How to regulate

Bank of International Settlements:central bank to all the world's central banks

Issuance of guideline: Basel I, II and III. Suggested guidelines that are supposed to be adopted by central banks.

The most important thing that BIS does is to set up the capital adequacy requirement to prevent banks from recklessly investing with insufficient risk capital.

Basel I: any government issued securities are 100 percent risk-free. any country securities are safe.

A L

Greek bonds deposits

100 100

Capital requirement for the most risky lending: commercial loan 8% capital requirement (100% risk weight)

Mortgage loans are deemed to be safer: capital requirement is 4% (50% risk weight)

GSE securities: capital requirement 1.6% (20% risk weight)

For a bank, if it originates a mortgage, sells it to Fannie, (btw get a fee for selling the mortgage), and buys it back in a bundle of MBS, that very same mortgage would only require 1.6% of the capital requirement.

NOW the capital requirement for all mortgage is 1.6% requirement, including prime and subprime mortgages.

Commercial banks get money in 3 ways from this process: interest on mortgage, fee for selling mortgage to the Fannie in the first place, a lower capital requirement

SPV: off-balance sheet activities to avoid any capital requirement. (Bearstone)

Investment banks were not totally reckless:

(1)double A and triple A mortgages were demanded the same capital requirement, and double A mortgages had a higher yield, but most investment banks still chose triple A mortgages

(2) greed is about making money rather than losing money

(3) the problem may be overconfidence

(4) they bought CDSs for protection

In a free market, banks will use different algorithms to evaluate the mortgages, there may even be speicalization. Besides, with support of FDIC, banks will compete for deposits and tend to self regulate better. The bank runs are disciplining them.

Drawbacks of branching of banks:

(1) we see a draining of deposit funds from local communities to other parts of the country.

(2) Banks become much larger and resemble "too big to fail".

Regulation in financial sectors may be the clearest test of how regulation works in a market. In other words, if regulation works anywhere, it must be the case that it works best in terms of financial market. Reason: Compared to other sectors, transparency in financial market is higher. Banks report vast quantities of data to regulators, and it is very easy for regulators to check those numbers.

Why is financial regulation doomed to fail?

(1) Ordinary people don't care about risks in their banks---- most people cite location as the most important reason for choosing a bank.

(2) Standardization: getting a mortgage or a loan is the same process no matter the banks are. Different banks evaluate them in the same way, following the guide lines of the Fed. The influence of the Fed goes beyond banks' balance sheets because banks follow the guidelines of the Fed.

(3) Less competition--regulation puts barrier in the way of starting a new bank.

(4) Less choice--can't share its own currency. (But most banks still provide checking account, which is private money, consisting a large chunk of the whole money supply in the economy.)

The creation of derivatives doesn't eliminate the risks. What we should care about is to when risks will explode and harm other people. It's not possible to prevent crisis from happening.

The point of regulation is to protect the sanctity of the payment system.

How to regulate

Bank of International Settlements:central bank to all the world's central banks

Issuance of guideline: Basel I, II and III. Suggested guidelines that are supposed to be adopted by central banks.

The most important thing that BIS does is to set up the capital adequacy requirement to prevent banks from recklessly investing with insufficient risk capital.

Basel I: any government issued securities are 100 percent risk-free. any country securities are safe.

A L

Greek bonds deposits

100 100

Capital requirement for the most risky lending: commercial loan 8% capital requirement (100% risk weight)

Mortgage loans are deemed to be safer: capital requirement is 4% (50% risk weight)

GSE securities: capital requirement 1.6% (20% risk weight)

For a bank, if it originates a mortgage, sells it to Fannie, (btw get a fee for selling the mortgage), and buys it back in a bundle of MBS, that very same mortgage would only require 1.6% of the capital requirement.

NOW the capital requirement for all mortgage is 1.6% requirement, including prime and subprime mortgages.

Commercial banks get money in 3 ways from this process: interest on mortgage, fee for selling mortgage to the Fannie in the first place, a lower capital requirement

SPV: off-balance sheet activities to avoid any capital requirement. (Bearstone)

Investment banks were not totally reckless:

(1)double A and triple A mortgages were demanded the same capital requirement, and double A mortgages had a higher yield, but most investment banks still chose triple A mortgages

(2) greed is about making money rather than losing money

(3) the problem may be overconfidence

(4) they bought CDSs for protection

In a free market, banks will use different algorithms to evaluate the mortgages, there may even be speicalization. Besides, with support of FDIC, banks will compete for deposits and tend to self regulate better. The bank runs are disciplining them.

4/23/2013

Summary of The Problem of Transaction Costs

I.

The problem to be examined

This paper is about negative externalities of one business firm

upon others. The traditional economics analysis, developed by Pigou, contends

that the firm is liable for the damage and that the firm should either pay tax

of equivalent amount of the damage or close the factory in that area. But

professor Coase argues in this article that such analysis is inappropriate and

often leads to undesirable outcomes.

II.

The reciprocal nature of the problem

The traditional approach focuses on how to restrain the negative

externalities of the firm, but this analysis is wrong because the external cost

is not simply a cost produced by the firm and born by the victim; instead, the

problem is of reciprocal nature. The real question is to decide whether one

group is allowed to harm the other or vice versa. The proper way of analysis is

to determine in total and at margin whether the value of protection is worth

the cost of restraining the firm.

III.

The pricing system with liability

and damage

When the firm has to pay all damage it caused and the transaction

cost is zero, there will be a desirable solution. If the firm that imposes

negative externalities is liable for the damage, it will take into

consideration the marginal social cost of its production, and based on

cost-benefit analysis, it will either reduce production or pay to victim as

compensation. On the other hand, the victim will reach a bargain with the firm

based on his examination of negative externality cost and benefits. The both

parties have to consider the opportunity cost, and if the cost is greater than

the value they can get, then in a competitive market, they will reallocate the

resources and reach a mutually beneficial outcome. The outcome of the bargain

depends on preferences and negotiation skills of two parties, but the net

social gain is the same.

IV.

The pricing system with no liability

and damage

If the damaging business is not liable for the damage it has

caused, but the transaction cost is zero, then the allocation of the resources

will be the same as it was when the firm was liable for the damage. In this

case, the victim will pay the amount no larger than externality cost to the firm

for less damage, and the firm will accept it if the amount is larger than the

value of its marginal product. If this transaction doesn’t happen, the victim

will move out and no negative externalities would happen. As it is the case in

III, the outcome depends on the value of firm’s marginal production and its

cost on the victim.

It is necessary to know if the damaging business is liable for the

damage since the establishment of the delimitation of right facilitates market

transaction, but as long as the transaction cost is zero, people would bargain

with one another to produce the most efficient distribution of resources,

regardless of the initial legal position.

V.

The problem illustrated anew

Problems of negative externalities can assume various forms in

life. But the bottom line is that the problem is caused by both pollutant and

the victim. The economic problem in all cases of harmful effects is how to

maximize the value of production. The immediate question courts have to cope

with is who has the legal rights to do what, but as long as the transaction

cost is zero, the decisions of the courts concerning liability for the damage

have no effect on the final allocation of resources. A legal rule that

arbitrarily assigns blame to one of the parties gives the right result when

that party happens to be the one that can avoid the problem at the lower cost.

VI.

The cost of market transaction taken

into account

In real life, many welfare-maximizing reallocations are forsaken

because of high transaction costs in the process of bargaining. In this

situation, the initial delimitation of property rights will affect the

efficiency with which the economic system functions.

A firm could reach the efficient outcome, but the administrative

cost for firm to organize a transaction isn’t strictly less than that from the

market. People will use firm to organize a transaction when its costs are less

than the cost incurred through market.

When the transaction cost of the firm is very high, an alternative

option is direct government regulation. The government, to some extent, is a

super-firm because it can influence the use of factors of production by

administrative decision and it can avoid the market competition. The government

can use its power to get things done at a lower cost, but the administrative

machine itself isn’t costless, and the regulation may not be efficient. All

solutions have costs and there is no reason to suppose that government

regulation is called for simply because the problem is not well handled by the

market or the firm. The law should produce an outcome similar to what would

result if the transaction costs were eliminated. Hence courts should be guided

by the most efficient solution.

VII.

The legal delimitation of rights and

the economic problem

The courts should take into consideration the economic consequence

of their decision. A comparison between the utility and harm produced is an

element in deciding whether a harmful effect should be considered a nuisance.

The problem of negative externalities isn’t about restraining those

who are responsible for them; instead, the problem is to decide that, given the

negative externalities, whether the gain from preventing the harm is greater

than the loss resulted from stopping the action that produces the harm. In a

world with transaction costs, courts make decisions on economic problem and

determine how resources are to be allocated. The courts are conscious of this

and they make comparisons between what could be gained and what would be loss

by preventing the actions. The delimitation is also the result of statutory

enactment. Sometimes courts may protect the firm too far.

VIII.

Pigou’s treatment in “economics of

welfare”

The existence of externalities does not necessarily lead to an

inefficient result. Pigouvian taxes, even if they can be correctly calculated,

do not in general lead to the efficient result.

IX.

The Pigovian tradition

For Coase, the idea that firm should be forced to compensate those

suffer from negative externalities is the result of not comparing the total

product attainable within various social arrangements. A tax system which is

confined to a tax on the producer of the damage caused will lead to higher cost

of solving the problem if the alternative solutions incur fewer costs. In

addition, Pigouvan taxation begs the question of detailed information of

personal preferences, which is hard to achieve in real market. What’s more,

even if the problem of information is solved, tax will increase because more

people will live in the vicinity, incurring reciprocal negative externalities

on firms. If regulation is truly inevitable, the goal is to approach the

optimum amount of negative externalities rather than just eliminate harm

regardless of the cost.

X.

A change of approach

Coase believes that analysis in terms of divergence between social

and private cost of products pays close attention to particular deficiencies in

market and tends to nourish the belief that any mechanism eliminating the

deficiencies would be desirable, but such mechanism may induce unintended

consequences.

Pigouvan analysis proceeds in terms of a comparison between a state

of laissez-faire market and an ideal world. Coase suggests that a better

approach should examine the transaction costs and delimitation of property

rights, conduct cost-benefit analysis on various proposals and decide which

institution to set up.

Coase thought that failure to cope with externalities correctly

results from a wrong concept of a factor of production. Factors of productions

are a right for a person to perform certain actions on his property. The cost of exercising a right is the loss

born somewhere else in consequence of exercising the right. In deciding social

arrangements in which individual decisions are made, Coase believe that all

solutions have costs and there is no reason to suppose that government

regulation is called for simply because the problem is not well handled by the

market or the firm. Economists should account for total effect of each proposed

arrangement to make the best decision.

The ultimate thesis is that law and regulation are not as important

or effective at helping people as lawyers and government planners believe. Coase

and others like him wanted a change of approach, to put the burden of proof for

positive effects on a government that was intervening in the market, by

analyzing the costs of action.

Subscribe to:

Comments (Atom)